It's Election Day!! Check your email to vote for both Class and Student Body Officers. Voting closes at 10:15 a.m. Friday, April 18. Winners will be announced at 3:20 p.m. on Friday.

🌊✨ Set Sail on the Adriatic Odyssey!

Twin Falls High School is going to Greece and Italy in 2026! 🌍 Explore ancient ruins, crystal-clear waters, and breathtaking landscapes on this once-in-a-lifetime adventure!

📢 Info Meeting: April 22, 2025, at 7 PM

🔗 RSVP Now: https://bit.ly/4c3f0GU

💰 RSVP to unlock a $200 discount!

⏳ Spots are filling fast—secure yours today!

Don't miss out on a thing this week! Senior Nights for Baseball and Softball, Tennis, Track, and PROM!!

Congratulations to Coach Burk and her Speech students this weekend at the State tournament, which included:

Maddox McClymonds, Emma Adolf, Eunsue Sheen, and Josie Preucil breaking into the semifinals.

Eunsue and Josie double breaking into the finals and....

Josie placing as a state champion in Impromptu Speaking,

All of which helped the team earn the 3rd place trophy!!

Today is the last day for Jr. Jive sign-ups!

The TFHS Bruin Tennis team put on “Hit it for Harper,” a junior tennis camp with over 40 participants. All proceeds are being gifted to the Harper Walker family. Members of the Bruin Tennis team shared their skills and support for their classmate, Harper. Thanks, Coach Sato and tennis team, for your thoughtfulness and generosity. #hititforharper 🎾💙

On Saturday, 3 Bruins were crowned District Speech Champs: EMILY WRIGHT in Extemporaneous Speaking, JOSEPHINE PREUCIL in Impromptu Speaking, and KATELYN MILLER in Sales Speaking!

State Qualifiers:

Extemporaneous Speaking: 1st Place District Champion- Emily Wright, 3rd Place- Josie Preucil, 4th Place- Maddux McClymonds

Communication Analysis: 3rd Place- Eunsue Sheen

Impromptu Speaking: 1st Place District Champion- Josie Preucil, 3rd Place- Emily Wright

Informative Speaking: 2nd Place- Shannon Brammer.

Radio Broadcast Journalism: 2nd Place- Katelyn Miller, Qualifying to State- Richard Roper, 1st Alt- Emily Nave

Sales Speaking: 1st Place District Champion- Katelyn Miller, 3rd Place- Emma Adolf

Panel Discussion: Qualifying to State- Emma Adolf, Sage Larson

Humorous Interpretation: Qualifying to State- Richard Roper

After Dinner Speaking: 1st Alt- Micala Wood, 2nd Alt- Nayh Zavala

Congratulations to Coach Burk, Coach Pritchard, and the Speech students! Amazing showing!

Last week, Jacob Stombaugh and Rebecca Campbell received their FFA state degrees, which only 6% of all members received. Congratulations, Rebecca and Jacob! Mr. Campbell continues to build the FFA program; his dedication shows!

Whatcha doin Saturday? Consider attending this fun event, Saturday April 12th at Noon a the Visitor Center. Last year TFHS won the Red Heel Trophy for most school participation. Students are FREE! Check in at the registration table and let them know you are from TFHS.

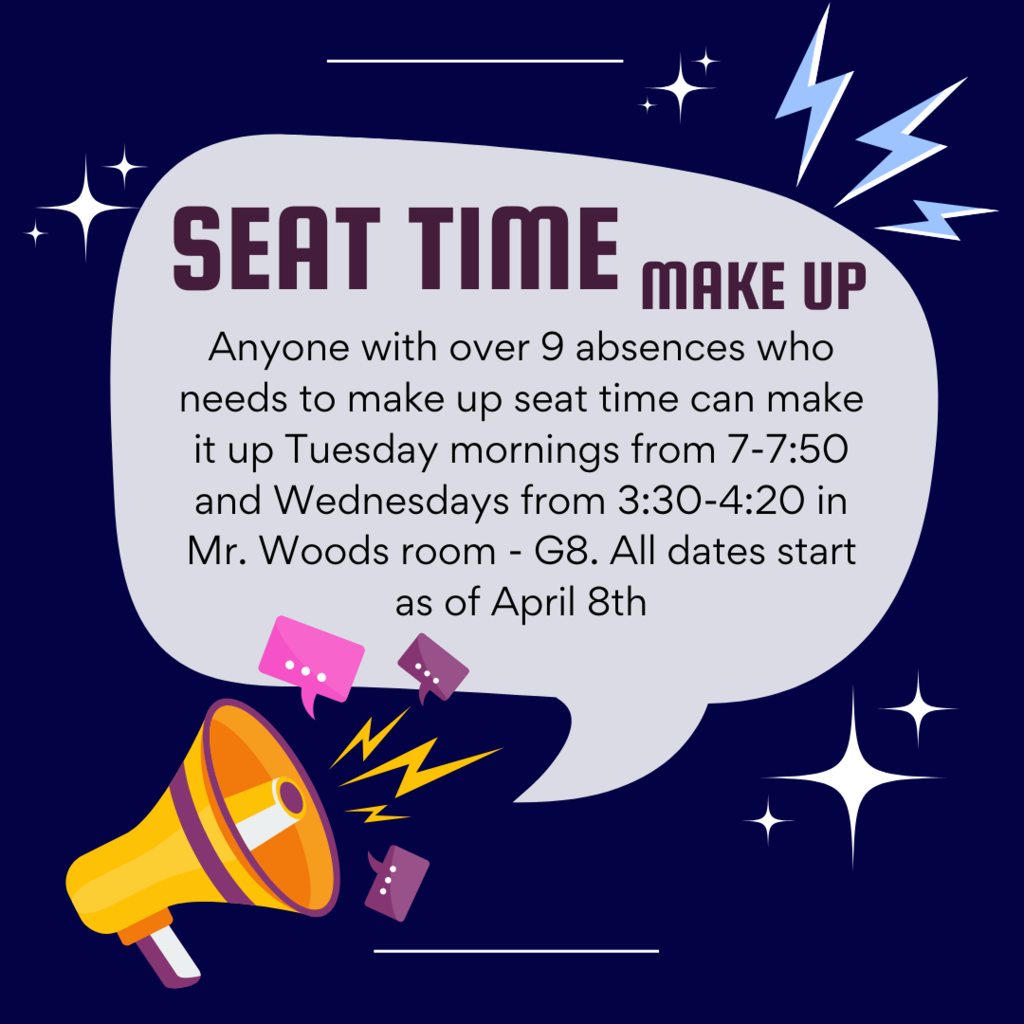

Too many absences? Make sure you get your seat time in.

It's another fun week of spring☂ sports and activities. Be there or be 🟦. 🐻

Help BPA get their students to NATIONALS next month! Students will earn 20% of the sales from Panda Express on April 10 between 3 p.m. and 10 p.m. YOU MUST SHOW THIS FLYER when ordering for the students to earn the money. Help these amazing students make it to their competition!

Come celebrate with us at the JIVE Spring Showcase featuring our newest medley, Singin' in the Rain!☂☔ Mark your calendars!📅 #2k25JIVE

Get Excited! It's Tryout Season. Make sure to fill out the form at the link below. Can't wait to see you there!!

https://docs.google.com/forms/d/e/1FAIpQLSeZ8zSvvSoxOjpEeQttmkjwkqxmg1MQiyLAzqT8obuxZvOw7g/viewform

Love to dance? Join the 3 time district champs, the Bruinettes. Tryouts April 22 & 24th.

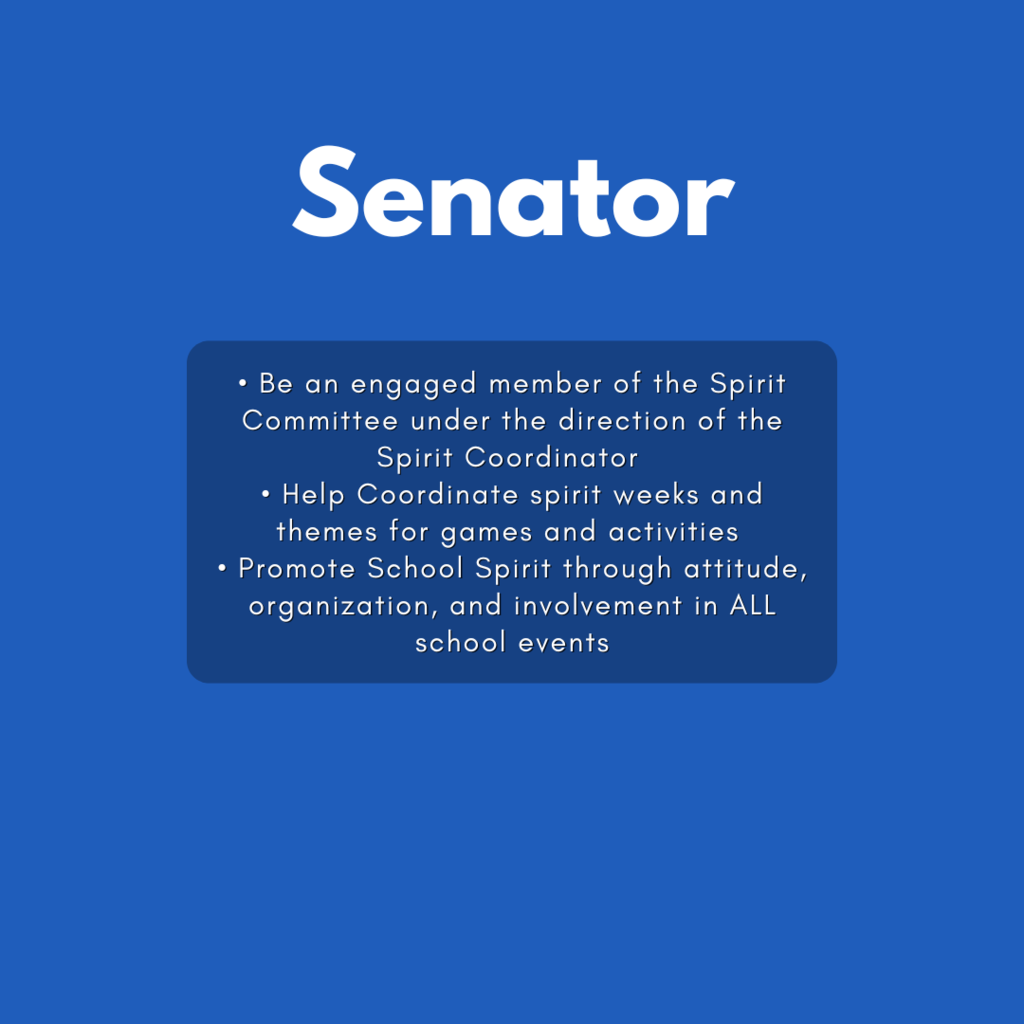

Calling all students in the Class of 2028. It is time to make your mark on TFHS! Join Student Council and help make decisions on activities and events here at the school. Plus....it looks really good on college and job applications! Check your email for the affidavit and get it submitted by Friday, April 4.

Are you going to be a Junior next year? Then check this out! Join Student Council and help plan the Service Bowl activities, Mr. TFHS, and Prom. Only you can make the changes you want to see. Check your email for the affidavit and get it in before Friday, April 4.

Junior Jive is a day camp where kids 2nd to 8th grade can come and join Jive in learning a brand new dance that they will perform later that day with Jive during the Saturday Matinee on April 26! Lunch and T-shirts will be provided! Please come join us in this awesome opportunity!

For the month of April, Sources of Strength invites you to join us in focusing on Healthy Activities. This month, we’re reminding ourselves about the importance of taking care of our well-being, especially when we’re feeling stressed. Engaging in healthy activities—whether physical, social, or emotional—can make all the difference. These activities not only help us unwind but also lift our mood and provide clarity.

Taking time for self-care, even in small ways, is essential for staying balanced and focused. Whether it’s going for a walk, connecting with a friend, or simply taking a moment to breathe, it’s important to find what works best for you.

We also invite you to join us every Wednesday by wearing blue and/or your boots as we reflect on how we can better take care of ourselves.

Class of 2026, are you ready to be SENIORS?!?! Make your senior year everything you want it to be by joining Student Council. check your email to find the affidavit and make sure you submit it by Friday, April 4.